T Bill Calculator Excel

Introduction to T Bill Calculator Excel

When investing in Treasury bills, also known as T bills, it’s essential to understand the calculation of returns and the yield on your investment. Excel, being a powerful tool for financial calculations, can be utilized to create a T bill calculator. This calculator helps investors determine the purchase price, interest earned, and yield of a T bill based on its face value, interest rate, and time to maturity.

Understanding T Bill Basics

Before diving into the calculator, it’s crucial to understand the basics of T bills: * Face Value: The amount that will be paid at maturity. * Interest Rate: The rate at which interest is earned, expressed as a decimal. * Time to Maturity: The duration until the T bill matures, usually expressed in days. * Purchase Price: The price at which the T bill is bought, which is less than the face value due to the discount nature of T bills.

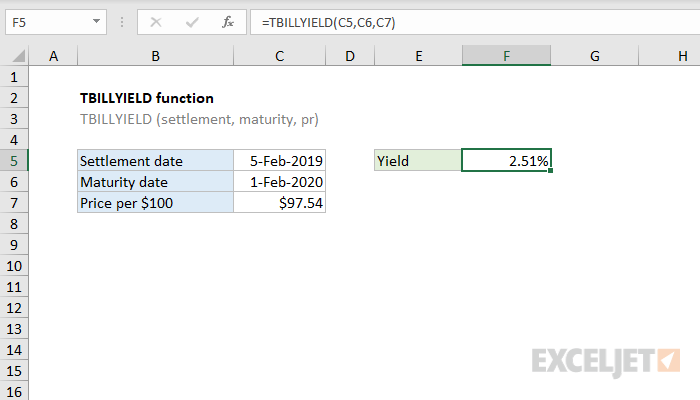

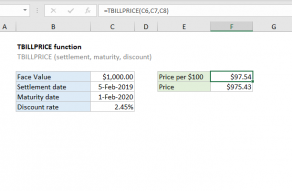

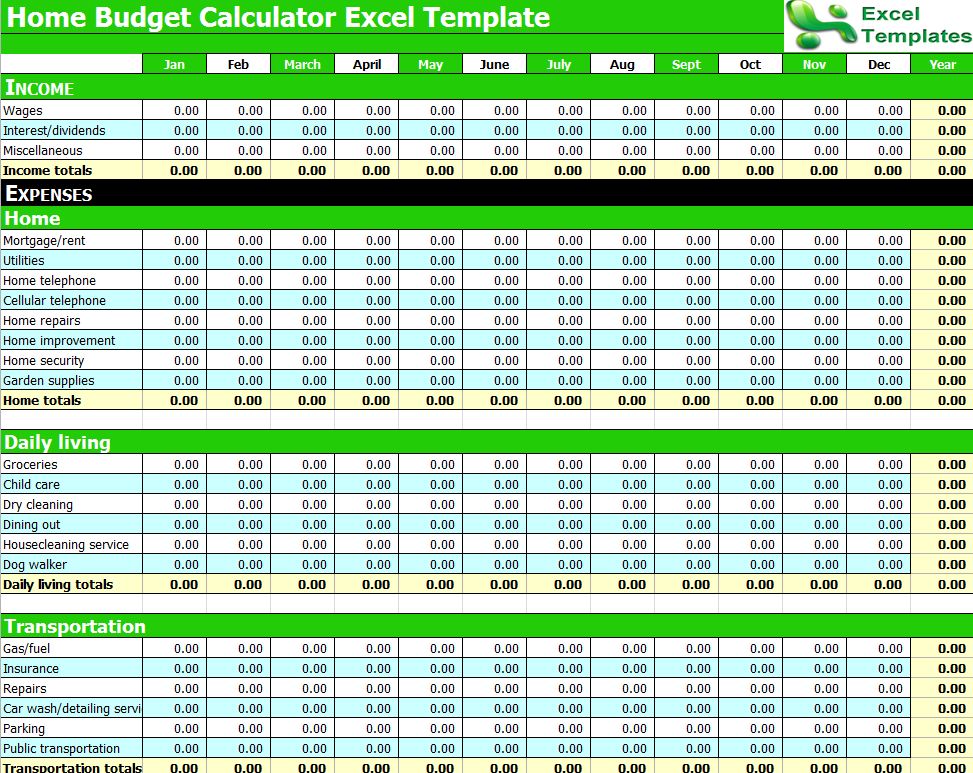

Creating a T Bill Calculator in Excel

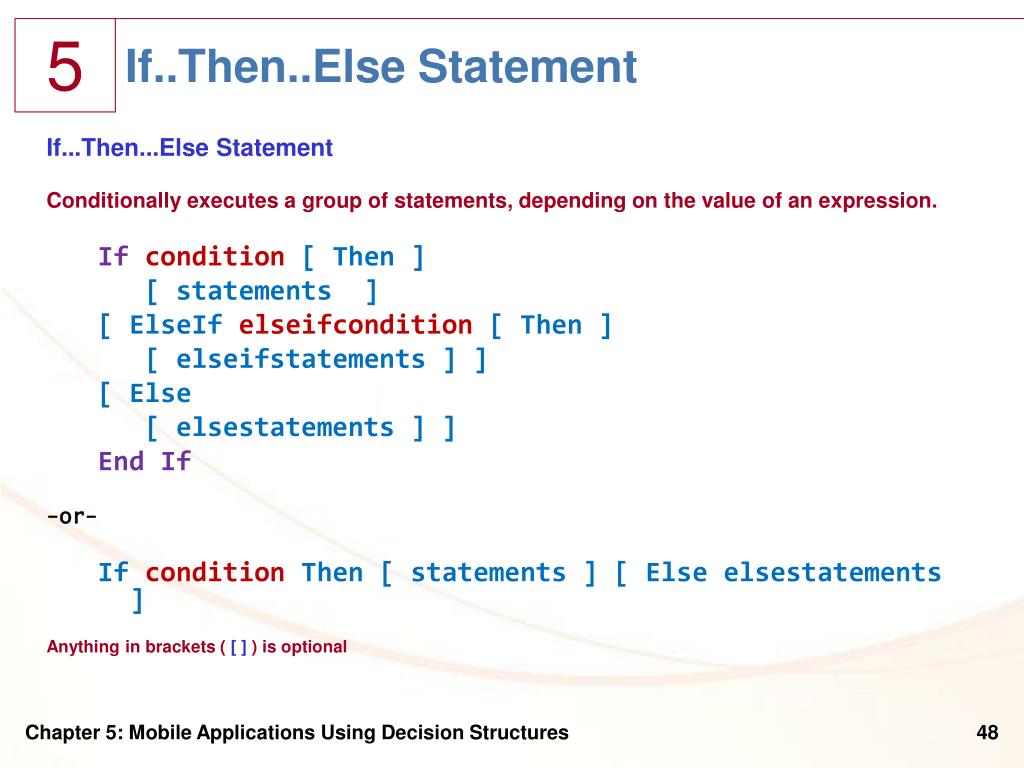

To create a basic T bill calculator in Excel, follow these steps: 1. Open a new Excel spreadsheet and set up columns for Face Value, Interest Rate, Time to Maturity, and Purchase Price. 2. Use the formula for calculating the purchase price of a T bill:Purchase Price = Face Value * (1 - (Interest Rate * Time to Maturity / 360)).

3. Input the formula into the Purchase Price column, using the values from the respective columns for Face Value, Interest Rate, and Time to Maturity.

4. Calculate the interest earned by subtracting the purchase price from the face value: Interest Earned = Face Value - Purchase Price.

5. Calculate the yield by using the formula: Yield = (Interest Earned / Purchase Price) / (Time to Maturity / 365).

Example Calculation

Let’s consider an example where the face value of the T bill is 1,000, the interest rate is 2%, and the time to maturity is 180 days. - Face Value: 1,000 - Interest Rate: 2% or 0.02 - Time to Maturity: 180 daysUsing the formula for the purchase price:

Purchase Price = 1000 * (1 - (0.02 * 180 / 360))

Purchase Price = 1000 * (1 - (0.02 * 0.5))

Purchase Price = 1000 * (1 - 0.01)

Purchase Price = 1000 * 0.99

Purchase Price = $990

The interest earned would be:

Interest Earned = 1000 - 990 = $10

And the yield calculation:

Yield = (10 / 990) / (180 / 365)

Yield = (0.010101) / (0.493151)

Yield ≈ 0.0205 or 2.05%

Using Excel for Complex Calculations

Excel can handle more complex calculations, including those involving compounding interest for longer-term investments or discount rates for calculating the present value of future cash flows. The key is setting up the correct formulas and ensuring that the inputs are correctly referenced.

Benefits of a T Bill Calculator

A T bill calculator in Excel offers several benefits: - Easy Comparison: Allows investors to compare different T bills based on their yield and return. - Precision: Provides accurate calculations, reducing the risk of human error. - Flexibility: Can be adjusted to calculate the yield and return for various investment scenarios.📝 Note: When creating financial calculators in Excel, it's essential to double-check the formulas for accuracy and ensure that the calculator is user-friendly for those who will be using it.

Enhancing the Calculator

To make the T bill calculator more robust, consider adding features such as: - Automatic Date Calculation: To determine the time to maturity based on the purchase and maturity dates. - Risk Assessment: Incorporating factors that might affect the yield, such as changes in interest rates or market conditions. - Comparison Tool: Allowing users to compare the yields of different T bills or other investment vehicles.

| Face Value | Interest Rate | Time to Maturity | Purchase Price | Interest Earned | Yield |

|---|---|---|---|---|---|

| $1,000 | 2% | 180 days | $990 | $10 | 2.05% |

In summary, creating a T bill calculator in Excel is a straightforward process that can greatly assist investors in understanding the potential return on their investments. By following the steps outlined and considering enhancements to the calculator, individuals can make more informed decisions about their financial investments.

What is the primary purpose of a T bill calculator in Excel?

+

The primary purpose of a T bill calculator in Excel is to help investors calculate the purchase price, interest earned, and yield of a Treasury bill based on its face value, interest rate, and time to maturity.

How do you calculate the purchase price of a T bill?

+

The purchase price of a T bill is calculated using the formula: Purchase Price = Face Value * (1 - (Interest Rate * Time to Maturity / 360)).

What is the benefit of using Excel for T bill calculations?

+

Using Excel for T bill calculations provides precision, flexibility, and ease of comparison between different investment options, reducing the risk of human error and allowing for more informed investment decisions.